|

Demystifying Horry County, South Carolina Property Taxes: A Comprehensive Guide

|

|

|

Navigating the intricacies of property taxes in Horry County, South Carolina, is a crucial aspect of property ownership. In this comprehensive guide, we’ll delve into the essential details of Horry County property taxes, including the critical distinction between Primary and Secondary residences, and the associated tax rates.

Unraveling the Basics of Horry County Property Taxes

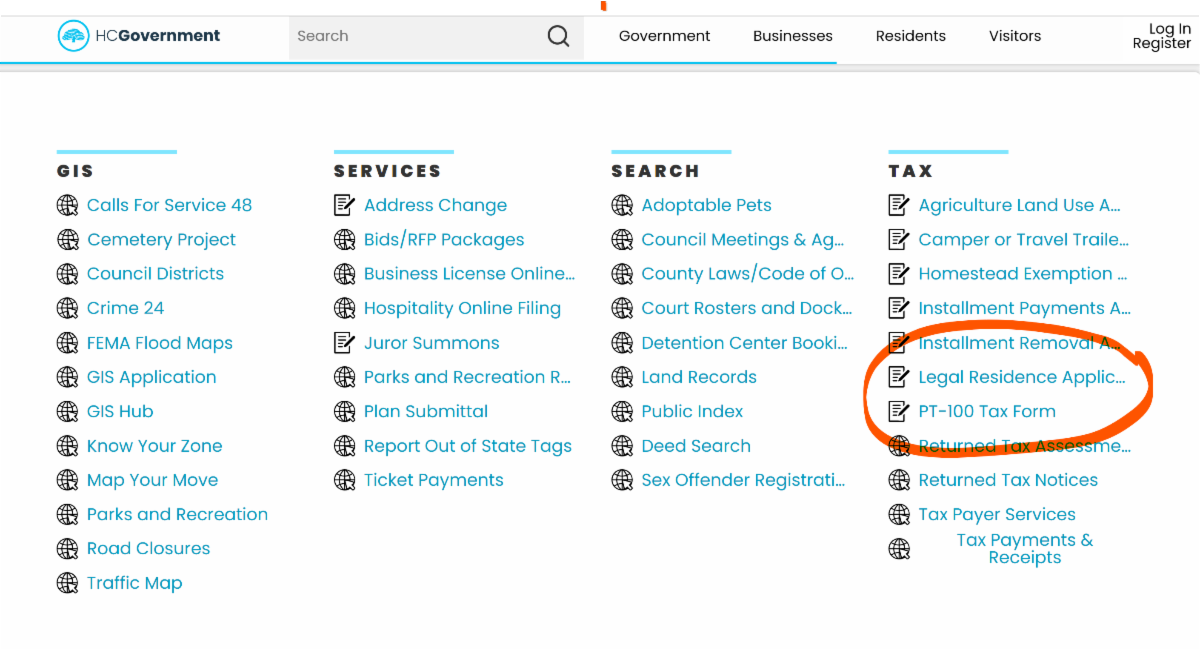

Understanding the fundamental components of Horry County property taxes is the first step towards effective management. The Horry County Tax Payer Services website is the official repository for all pertinent information, covering aspects such as tax assessments, payment methods, and crucial deadlines.

Recent developments in Horry County property taxes have been highlighted in a detailed report by WPDE. Keeping abreast of any changes in tax policies is essential to make informed decisions regarding property ownership.

Primary vs. Secondary Residences: Deciphering the Tax Rates

A pivotal factor influencing property taxes in Horry County is the classification of your property as either a Primary or Secondary residence. The tax assessment rates are distinct for each category.

Primary Residence (4% Tax Rate): A property that serves as your primary dwelling qualifies for the 4% tax rate. This applies to residences that you primarily inhabit.

Secondary Residence (6% Tax Rate): In contrast, if your property is used for other purposes, such as rental or vacation, it is categorized as a secondary residence. The tax rate for secondary residences is set at 6%.

|

|

|

Minimum Required Documents for Application Consideration

- Owner/Applicant(s) and Spouse: South Carolina License or Identification Card for ALL applicants.

- Vehicle Information: South Carolina vehicle registration for all vehicles at the current address. For company-owned cars, provide registration displaying the business address.

- Tax Returns:

- Federal with Schedules 1 & E

- State with Schedule NR, if applicable

- Social Security Benefits:

- Most recent benefit letter.

If applicable:

- Copy of court-ordered “Complaint for Separate Support & Maintenance” agreement if separated.

- Divorce decree if less than 5 years.

For “Active” Military Personnel Only:

- Military Identification.

- Copy of current Orders for South Carolina.

- Copy of current “Leave and Earnings Statement” (LES) – please redact income information.

- Military members and their spouses MUST provide their driver’s license(s) and vehicle registration(s) regardless of where they are licensed or registered.

- If the owner or spouse is a “Citizen” of another country, a copy of the “Permanent Residence Card/Green Card” MUST be provided.

Additional Documentation Required Where Applicable:

- Copy of Trust or Recorded Certificate of Trust.

- Articles of Incorporation.

- Operating Agreement for LLC.

- Letter of Explanation.

Important Reminders:

- All necessary supporting documents must be provided within 15 days. Missing documents can be submitted via email (askTPS@horrycountysc.gov), fax (843-915-6040), or mail (1301 2nd Ave, Suite 1C08, Conway, SC 29526).

- Ensure your Property Identification Number (PIN) is referenced on your documents.

- If any supporting documents are unavailable, please provide a written explanation.

- Incomplete applications or those lacking supporting documents may result in denial. A new application with the necessary documentation will need to be submitted.

- We will thoroughly review, research, and verify your application, and will contact you if further information is needed.

- If you are married, your spouse must provide all required documentation, even if they do not have ownership of the property or do not occupy it.

Note for Mobile Homes:

Mobile homes must be titled with the Department of Motor Vehicles (DMV) and Registered with Manufactured Homes at the Assessor Office before initiating the Special Assessment process.

|

|

Maximizing Savings through Strategic Tax Assessment Management

Effectively managing your property’s tax assessment is pivotal in minimizing your overall tax liability. Understanding how your property’s value is determined and the factors influencing the assessment process is critical.

Factors impacting Tax Assessment include:

Location and Neighborhood: The neighborhood and location of your property play a significant role in its assessed value.

Property Size and Features: The size and unique features of your property are key factors considered in the assessment process.

Comparable Property Sales: Recent sales of properties similar to yours in the area are a crucial benchmark for assessment.

Challenging tax assessments is a right afforded to property owners. If you believe your property has been overvalued, you can contest the assessment, potentially leading to a reduction in your property tax bill.

Below are the physical locations to go in person.

|

|

The Road Ahead: Informed Property Tax Management

Navigating Horry County, South Carolina property taxes demands a comprehensive understanding of the tax structure and assessment process. The distinction between primary and secondary residences plays a pivotal role in determining the applicable tax rates. By staying informed about recent changes in tax policies and seeking expert advice when needed, property owners can optimize their approach to property taxes in this dynamic coastal county.

Remember, proactive tax management not only ensures compliance but can also lead to substantial savings in the long run. Leverage the resources at your disposal to make the most of your investment in Horry County, South Carolina.

|

|

|

HOW TO REDACT YOUR TAX RETURNS

Redact the return as shown (SC and other state returns have similar information to the 1040) using a heavy marker or pen to cover up:

- If a line is blank – leave it blank.

- If a line is filled in with a zero – leave the zero.

- If a line contains an N/A – leave the N/A.

- Do not redact Line 8 or 10.

The income amounts (dollar figures) are typically not needed for this process but it is necessary during the approval process for the Assessor’s Office to know if some lines contained data. Therefore, do not cover up the lines with plain paper and do not fold the form when copying to hide the income lines.

If you have any questions about redacting or about what parts of the returns are needed, call the Assessor’s Office at 843-915-5040. Customer service representatives will be happy to assist you and answer your questions.

CLICK HERE TO SEE IMAGE PROVIDED BY HORRYCOUNTY.GOV

|

|

|

|

|

Disclaimer: The information provided in this article is intended for general informational purposes only and should not be considered as professional advice. While we strive to ensure the accuracy and timeliness of the information presented, tax laws and regulations may change over time. Therefore, it is advisable to consult with a qualified tax professional or visit official government sources for the most up-to-date and personalized guidance regarding property taxes in Horry County, South Carolina. The author and publisher disclaim any liability for any actions taken based on the information provided in this article. Readers are encouraged to conduct their own research and seek professional advice as necessary.

|

|

|

The ongoing joke in my house is that I love my dog Gizmo more than anyone else in the house. Now we all know that is not true, but he doesn’t talk back, and he likes to snuggle unlike anyone else in my home, so…you can see why he may get loved on the most.😊

Because every dog deserves a loving home like Gizmo, we’re going to support NMB Humane Society by featuring a dog each week to help find them a loving home too.

|

|

|

|

|

|

Simba is the canine Einstein, and he’s not afraid to show it. From acing fetch to mastering the art of finding the squeaker in every toy, Simba’s athletic prowess knows no bounds. But it’s not all about play for this fur-midable scholar. Simba is wise beyond his dog years, like a fine wine in a world of kibble. He’s the kind of dog who prefers a good book over a wild party any day. Simba knows that in life, it’s not about the quantity of friends but the quality of belly rubs. He keeps a small circle of trusted companions, those who understand the importance of a well-placed treat and a scratch behind the ears. To meet Simba, please call 843-249-4948 to schedule an appointment, or you can submit an application HERE.

|

|

|

National I Love You Day is celebrated on October 14 in the U.S. Unlike Valentine’s Day, it extends beyond just couples. It’s a day to appreciate our families and friends, as well as anyone you hold dear.

|

|

|

|

|

|

|

TO EAT | MIMOSA’S SOUTHERN KITCHEN & BAR

7430 North Kings Highway Myrtle Beach SC 29572

Mimosas is a full service restaurant and bar serving delicious chef-inspired Breakfast and Lunch in a uniquely designed building with large and natural outdoor spaces.

|

|

|

|

|

TO DO | MYRTLE BEACH GREEK FESTIVAL

October 12-15, 2023

Thu-Sat: 11am-9pm

Sun: 12pm-7pm

A lively celebration of Greek culture! Indulge in authentic tastes, sights, and sounds.

FUN FACT: Did you know there is a “Myrtle Beach” in Greece? Pictured here is “Myrtos Beach”. Myrtos means Myrtle. Myrtos has been described as “one of the most dramatic beaches in Greece”, with its “mile-and-a-half long arc of dazzling white pebbles.”

|

|

|

|

|

|

|

|

TO SHOP | BUY CURIOUSLY

1626c Hwy 17 S

North Myrtle Beach SC 29582

Open Tues-sat 10-5

The most unique shopping experience at the beach! This colorful collaboration is a feast for the eyes featuring the work of over 100 artists eclectically blended with hints of vintage and funky retail lines that focus on upcycle, recycle, made in the USA, women-led and charitable! One of a kind finds with good vibes and retro flavor!

|

|

|

|

|

Some may know, many may not…I LOVE soup, I mean REALLY LOVE soup! I can eat it for breakfast, lunch and dinner. Yes breakfast and I know that may sound weird, but it is the perfect breakfast in my eyes, warm and light to start your day. I will feature my family’s favorite soups over the next few months. Today we feature my Roasted Eggplant Raviolini Soup.

|

|

Roasted Eggplant Raviolini Soup

|

|

|

Ingredients

- 2 tablespoons butter

- 1 tablespoon extra virgin olive oil

- 1 eggplant, half the skin peeled to make stripes and the flesh chopped into 1/4 inch cubes

- 2 garlic cloves

- salt and pepper

- 1-32 ounce can crushed tomatoes

- 32 ounces chicken broth

- 1lb ravioli

- 1 cup basil leaves, torn

- grated parmigiano-reggiano cheese for topping

Instructions

1. In a small soup pot, melt the butter and the olive oil over medium heat. Turn the pan and coat its surface. Add the eggplant and garlic and season with salt and pepper and cook until softened about 5 minutes. Add the chicken broth and tomatoes and bring to a boil. Add the raviolini and cook until tender 3 to 4 minutes. Stir in the basil.

2. Serve the soup in bowls, topped with cheese and fresh basil.

|

|

|

|

|

|

|